child tax credit october 2021

Second the size of the credit was substantially reduced from. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child.

October Child Tax Credit Payment U S Gov Connect

Families with a single parent also.

. The administration previously said the credit would be a refund of approximately 13 of their 2021 state income tax liability. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days to.

Likewise if a 17-year-old turns 18 in 2021 the parents are. For head-of-household filers the income. If you think thats why your October Child Tax Credit payment is missing you have two options.

The American Rescue Plan raised the earned-income. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600. The money starts phasing out if you earn more than 75000 as a single tax filer or 150000 if youre a married couple that files jointly.

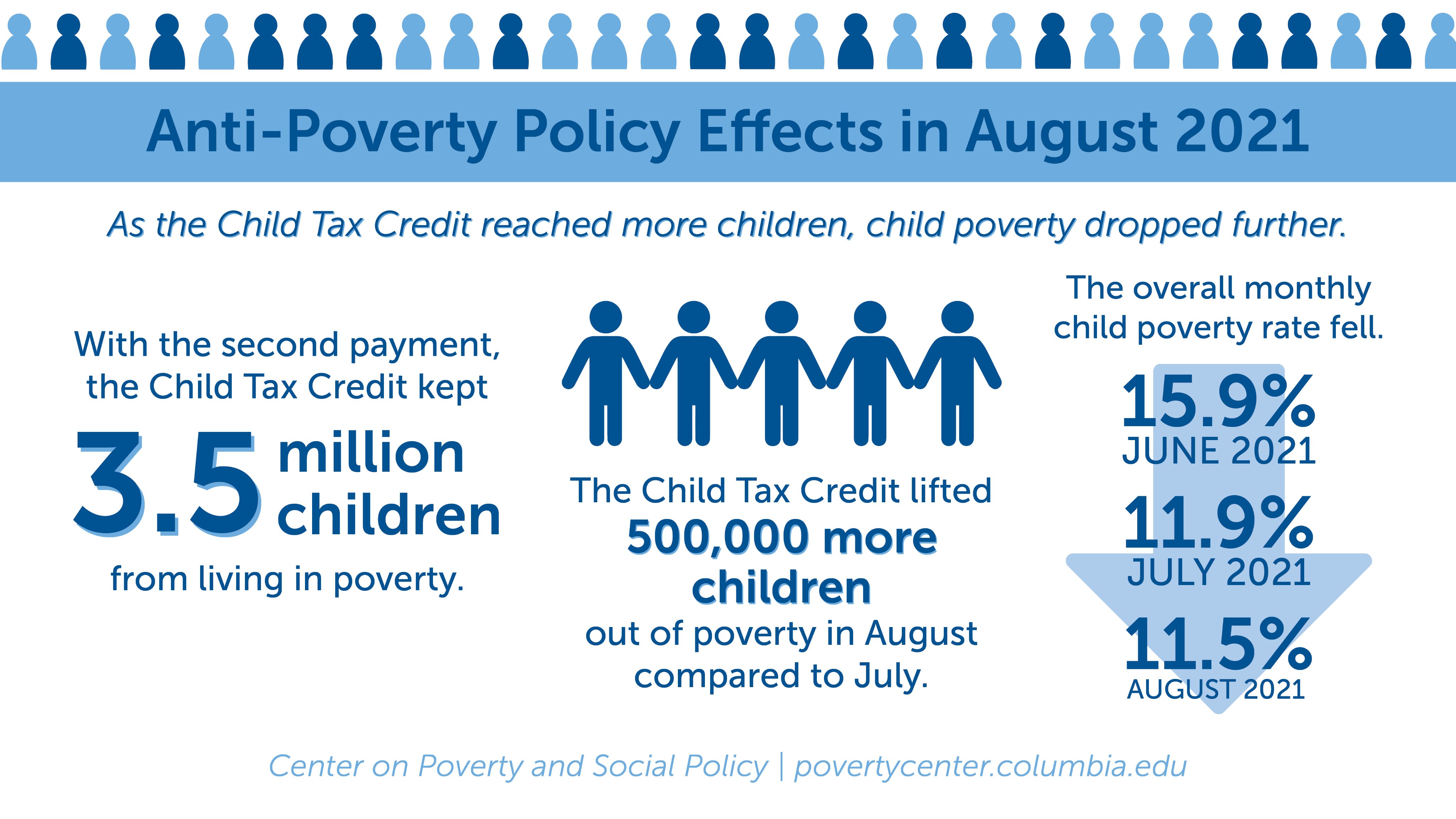

Thats just an estimate however -- it wont be finalized. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. One is to wait until you file your 2021 taxes next April and collect the payments. Thats an increase from the regular child tax.

New data proves how well it worked. October Child Tax Credit payment kept 36 million children from poverty Data Release Nov 30 Written By Barbara Lantz The fourth monthly payment of the expanded Child. WASHINGTON The Internal Revenue Service reminds families that some.

This meant that parents who earned less than the standard deduction would be unable to claim the full benefit. Households that file a 2021 return could also be eligible for the expanded child tax credit and the earned-income tax credit. If your payment is missing due to a delay because you misplaced it or if you provided the IRS with an incorrect bank account.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. All eligible families could receive the full credit if.

Grandparents and other relatives with eligible dependents can qualify for 2021 Child Tax Credit. WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. Individuals qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if they meet all eligibility factors and their annual income is not more than.

Filing a trace for October Child Tax Credit payment. The IRS said 2021 tax returns can also be filed at ChildTaxCreditgovfile. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The new 2021 US. Thats an increase from the regular child tax. Married couples filing a joint return with income of 400000 or less.

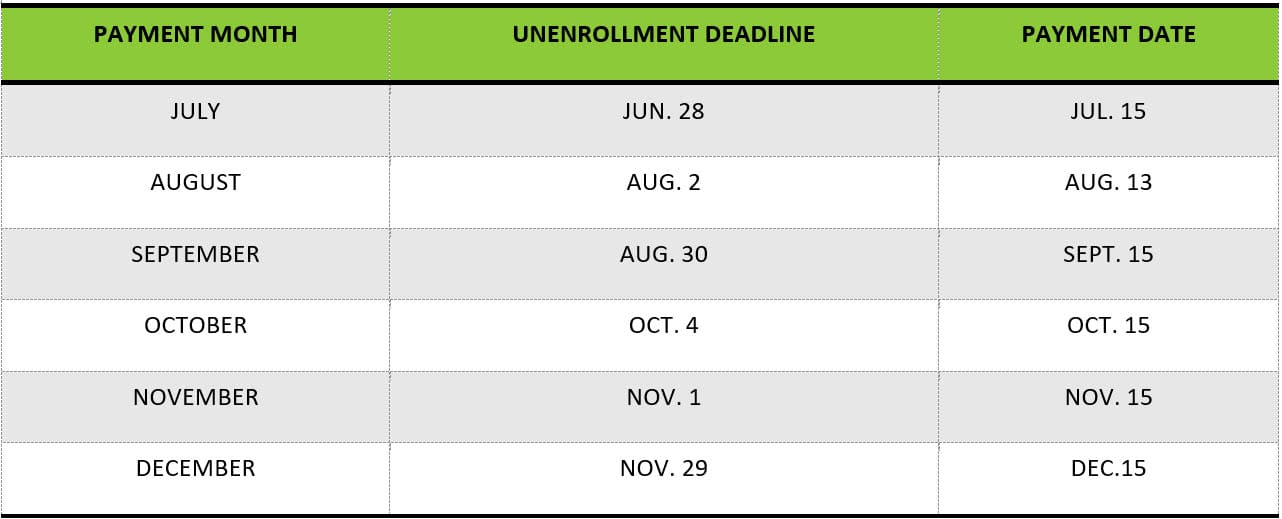

Individuals whose incomes are below 12500 and couples below 25000 may be able to file a. It is too late to opt out of the october payment as the deadline for this was october 4 but if you have decided that you no longer want or need to receive the child tax credit checks. All eligible families could receive the full credit if.

In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

Why You Didn T Get Your August Child Tax Credit Payment

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Center On Poverty Social Policy Cpsp On Twitter The Child Tax Credit Continues To Deliver In August 3 5 Million Children Kept Out Of Poverty 500 000 More Children Kept Out

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Child Tax Credit Updates Why Are Some Payments Lower In October As Usa

Child Tax Credit Update 2021 Parents Warned To Register For Monthly Payments Now As October Deadline Approaches The Us Sun

When Is The Child Tax Credit October Opt Out Deadline 10tv Com

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

You May Be Surprised By Cuts In October Child Tax Credit

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

What Families Need To Know About The Ctc In 2022 Clasp

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

Child Tax Credit Advanced Payments Information Bc T

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin

Advance Child Tax Credit Financial Education

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities